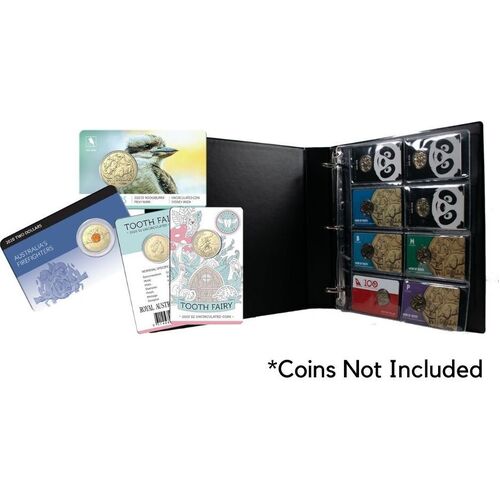

There are certain points you must keep in mind before purchasing medical insurance: Points to be remembered at the time of purchase of medical insurance Mediclaim is of utmost importance as it takes care of your medical expenditure bills, if you fall ill and require medical assistance. This insurance can be for the policy holder or for the spouse of the policy holder. The deduction of Mediclaim under Section 80D happens so that your insurance policy stays active. Deduction for Mediclaim under Section 80D Section 80C provides deductions up to Rs.1.5 lakhs per year while Section 80D offers deductions up to Rs.65,000, subject to conditions.Īnother differentiating point is that Section 80C includes investments made in a wide range of financial instruments such as small savings schemes, life insurance premium, mutual funds etc., while Section 80D is meant exclusively for deductions on health insurance premiums paid. Section 80D is sometimes confused with, Section 80C. Always consult an expert to get the most out of the tax saving provisions. Note: Please note that the maximum tax deduction which can be claimed is subject to the provisions under Section 80D of the Income Tax Act. Total tax deduction that can be claimed is Rs.67,000 out of the overall premium payment of Rs.67,000.Tax deduction of Rs.35,000 for your parents (senior citizens) out of the overall payment of Rs.35,000.Tax deduction of Rs.32,000 on Rs.32,000 paid as health insurance premium for you and your dependents.As per Section 80D terms, you are eligible for: Apart from this, you are also paying a health premium of Rs.35,000 for your parents’ policy, who are 80 years old. Suppose you are 60 years old paying an yearly premium of Rs.32,000 for yourself and your dependents. Self (senior citizen) and family + senior citizen parents The overall deduction limits are as follows:

Section 80D LimitĪs per Section 80D, a taxpayer can claim deductions on health insurance premiums paid for self/family and parents, apart from deductions on expenses related to health check-ups. Premium payments of any member in a HUF can be used for tax deduction subject to upper limit as per the act. Hindu Undivided Families (HUF) can also claim deductions under this section. The health insurance premium paid for the following members in a family are eligible for deductions: Eligibility for Tax Benefits under 80DĪ taxpayer can claim the deductions u/s 80D. The current increase in tax deductions on premiums paid toward any health insurance policy for a senior citizen will prove beneficial to senior citizens as well as anyone who pays health insurance premiums on behalf of a senior citizen, say a parent or spouse. In an effort to help senior citizens lead a dignified life in their old age, the government has made provisions for tax deductions on health insurance premiums and medical expenditure incurred by people aged 60 years and above (below 80 years). Budget 2018 is especially focused on taking care of senior citizens, women, and farmers of the country. He proposed a rise in the limit of tax deduction on health insurance premium from Rs.30,000 to Rs.50,000 under Section 80D of the Income Tax Act, 1961, for all senior citizens.

On 1st February, the Union Budget 2018 was announced by Former Finance Minister Arun Jaitley. Income Tax Calculator Union Budget - Rise in tax deduction under Section 80D

0 kommentar(er)

0 kommentar(er)